Corporate identity

Building world-class products

At Havells, we offer innovative FMEG products manufactured at our 14 state-of the art facilities across India, backed by our robust R&D capabilities, well-penetrated distribution network and strong brand recall. Over the years, we have established a strong presence in the domestic electrical appliances and equipment market, which is being bolstered by increasing penetration in the rural markets.

Know More

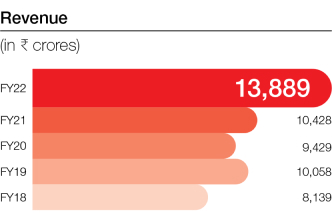

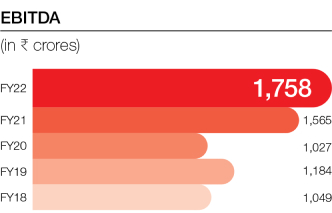

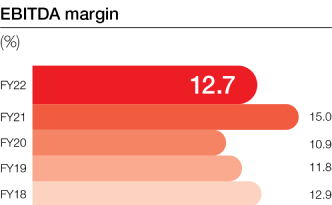

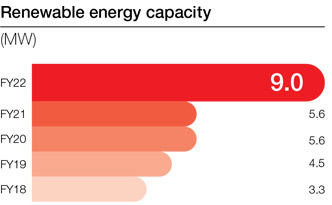

Performance highlights

Resilience amid

challenges

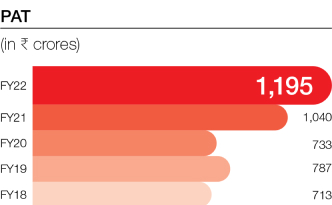

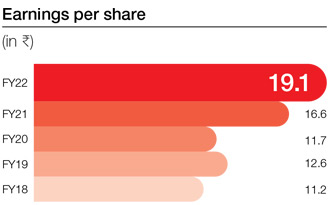

We delivered significant revenue growth, despite facing multiple headwinds such as rising raw material costs and subdued demand. Our margins however were impacted, as we could not fully pass on the increased input cost to the consumer.

Know MoreFinancial

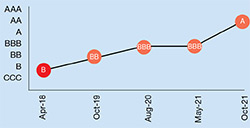

ESG Ratings

Chairman and Managing Director’s message

Delivering delightful experiences

Havells has strong brand salience in urban markets, and is expanding its footprint deeper into India. As electrification and income levels improve in rural markets, we are ready with an organised rural distribution network, with a unique product portfolio, suitable for these markets.

Anil Rai Gupta Chairman and Managing Director

Material topics

Mapping our priorities

We conducted a materiality assessment exercise to identify the topics most critical to value creation while better understanding our obligations towards our stakeholders.

Know MoreThe value creation story

Our performance

We have designed our business model to realise our vision to provide superior electrical and consumer durable products, while staying anchored to our core values. Keeping customers at the heart, we strive to deploy our financial and non-financial capitals optimally to maximise value creation for all our stakeholders.

Know MoreStrategic levers

Making Havells omnipresent

At Havells, we have outlined eight strategic levers to ensure our presence across the entire value chain and penetrate more markets.

Know MoreRisk management

Mitigating external challenges

We have put in place a robust risk Intregated Risk Management Framework, aligned with the internationally accepted framework issued by the Committee of Sponsoring Organisations of the Treadway Commission (COSO).

Know MoreStakeholder engagement

Aligning interests and expectations

Our engagement initiatives are guided by the principles of inclusivity, materiality and responsiveness, resulting in actionable insights that feed into our strategies.

Know More